Top tips on connecting with nature to improve your mental health

According to The Mental Health Foundation, There’s a lot of good research to support the role nature can play in protecting and supporting our mental health. For many of us though, ‘being in nature’ may not be as easy as it sounds. The good news is, you don’t have to climb a mountain to […]

Great tips from Royal London on how to look after your mental health

When you consider or take out life insurance, you might think more about the importance of being healthy. But taking care of yourself isn’t all about physical health – your mental health is important too. Around one in four people in the UK have a mental health problem each year, according to Mind, with worries […]

Mortgage Product Update 12/5/2021

The following updates were completed and are live in SOURCE today: Accord Accord have withdrawn a 5 year fixed product at 3.89% with a max LTV of 95%, and have launched 2 year fixed products with a max LTV of 95% under their new business Residential range. Bespoke by BOI Bespoke by BOI has made […]

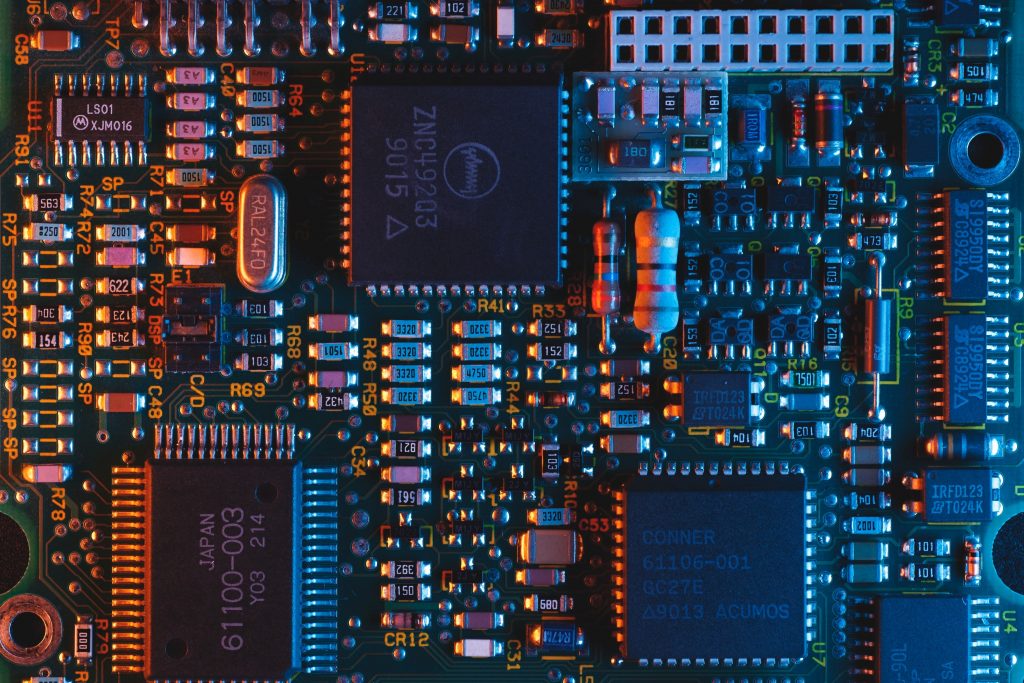

Ignore what technology can provide at your peril

In the mortgage market, I was brought up with a completely manual process, physical application forms, sending and receiving supporting documents by post and don’t let me bore you about how we went about sourcing mortgages! The amount of real paperwork was staggering. Many advisers practicing today have no conception of working without a computer, […]

Safety in numbers – the case for networks in an uncertain world

If there is one thing we have learned in the past 12 months it is that we all need the comfort of knowing that there is support around us when we need it. Support comes in many ways and might, for some, be as simple as knowing there is a business partner who appreciates the […]

Legal & General partners with HLPartnership on SmartrCriteria

Legal & General has worked with mortgage and protection network HLPartnership to simplify access for advisers using SmartrCriteria and SmartrFit search tools. The mortgage club says brokers will “benefit from a streamlined connection directly between the two providers” without “having to sign in multiple times” or “juggle numerous windows or tabs”. Legal & General announced […]

Government Outlines The Mortgage Guarantee Scheme

The Government has announced a new mortgage guarantee scheme to support a new generation in realising the dream of home ownership. This will increase the availability of 95% Loan-to-value mortgage products, enabling more households to access mortgages without the need for prohibitively large deposits. A number of the UK’s largest lenders including Lloyds, NatWest, Santander […]

Checking the checklist

So many of us are working from home at the moment, but I wanted to highlight the intermediary sector, and especially advisers who are working alone. Working from a home office can be a lonely business at the best of times. In a lockdown, when house calls to customers are off the menu along with […]

Buildings insurance blind spot could cost thousands during stamp duty rush

HLPartnership has warned that in the rush to complete property transactions by 31st March, it would be “too easy” to overlook putting buildings insurance in place ahead of completion. As the end of the stamp duty holiday looms, HLPartnership says a simple oversight in arranging buildings insurance could end up costing buyers thousands of pounds […]

HLPartnership – Supporting and Growing Your Business

2020 was quite the year – but through all the turbulence, HLPartnership remained dedicated to supporting members and providing the very best tools, technology and friendly bespoke service to grow your business in the toughest market conditions for over a decade. Last year, HLPartnership achieved a lot, including: Driving customer engagement through providing regular communications […]